In this article we have discuss about what is PAN card, importance of PAN card for students in India, importance of PAN card for students in Bank, importance of PAN card for student, main purpose of PAN card, Uses of PAN card, Benefit of PAN card, significance of PAN card, etc in details.

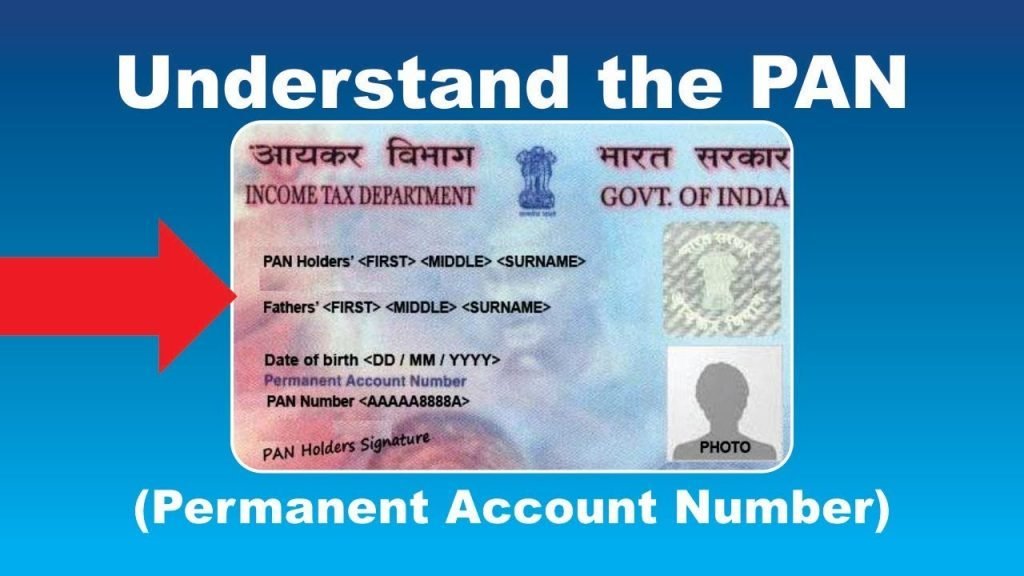

The Permanent Account Number (PAN) card is an essential document issued by the Income Tax Department of India. This ten-digit alphanumeric code holds great significance as it serves as an identification proof for individuals and entities carrying out financial transactions within the country.

Whether you are an employee, a business owner, or an investor, having a PAN card is crucial for various reasons.

In this article, we will explore the importance of PAN card. Lets starts explaining importance of PAN card.

Tax Identification

One of the primary functions of a PAN card is to act as a tax identification number for individuals and entities. Every taxpayer, whether salaried or self-employed, is required to have a PAN card to file income tax returns.

It helps the government track and monitor financial transactions, ensuring compliance with tax regulations. Without a PAN card, individuals cannot receive their tax refunds, apply for a new credit card, or conduct high-value financial transactions.

Banking and Financial Transactions

A PAN card is a prerequisite for various banking and financial activities. Opening a bank account, whether savings or current, requires the submission of PAN card details.

Moreover, when applying for loans, such as home loans, personal loans, or car loans, financial institutions require PAN card information to establish the borrower’s credibility. It also enables authorities to track transactions and prevent money laundering and other illegal activities.

Investment and Trading

If you wish to invest in the stock market, mutual funds, or other financial instruments in India, having a PAN card is mandatory.

It acts as a unique identifier for investors, facilitating the smooth processing of transactions and helping the government maintain a record of investments made.

Furthermore, a PAN card is required to open a Demat account, which is necessary for holding shares in electronic form.

Read More : Consideration in Contract Law Notes Pdf – Indian Contract Act 1872

Government Services

PAN card is often required while availing various government services and schemes. It is crucial for applying for passports, obtaining driving licenses, and participating in government tenders.

Additionally, PAN card details are necessary for registering for Goods and Services Tax (GST), enabling businesses to comply with tax regulations and file GST returns.

Income Tax Compliance

The PAN card plays a crucial role in ensuring income tax compliance. It helps the government keep track of taxable transactions, such as salary income, business income, capital gains, and other sources of income.

By linking financial transactions to a unique PAN, the Income Tax Department can effectively monitor tax liabilities and identify any discrepancies or instances of tax evasion.

Proof of Identity and Address

Apart from its significance in financial transactions, the PAN card also serves as a valid proof of identity and address.

It is widely accepted as an identity document for various purposes, such as applying for a SIM card, obtaining a gas connection, or participating in government examinations.

Its acceptance as a valid proof of identity simplifies administrative processes and reduces the need for multiple documents.

Read More : Nature And Kind Of Contract – Indian Contract Act 1872 Notes

Ease of Business Operations

For businesses, having a PAN card is crucial for conducting various operations smoothly.

It is required for obtaining business licenses, registering for import-export codes, participating in government tenders, and complying with Goods and Services Tax (GST) regulations.

Businesses can also use the PAN card to verify the authenticity of their vendors and suppliers, thereby ensuring a transparent and trustworthy business ecosystem.

International Transactions

A PAN card is also required for certain international financial transactions. If you plan to invest in foreign securities, open a foreign bank account, or engage in foreign currency transactions, having a PAN card is often mandatory.

It helps in establishing your Indian tax residency status and ensures compliance with foreign exchange regulations.

Prevention of Tax Identity Theft

Tax identity theft is a growing concern globally. Criminals may use someone else’s identity to file fraudulent tax returns and claim refunds illegally.

By linking financial transactions to individuals through PAN cards, the tax authorities can detect and prevent such fraudulent activities, safeguarding taxpayers’ interests and maintaining the integrity of the tax system.

The PAN card is not just a mere identification document; it plays a vital role in facilitating financial transactions and ensuring financial transparency in India. From filing income tax returns to conducting high-value transactions and participating in government services, the importance of PAN card cannot be overstated.

It acts as a key to unlock numerous financial opportunities and helps in maintaining the integrity of the country’s financial system.

So I hope, are you like this article so please share this article to your friend, relative and other. if you have any question about PAN card please comment this question so i will reply your question.

Read More : Capacity To Contract Notes Pdf – Indian Contract Act 1872